Originally Published at The Last American Vagabond

As U.S. Presidential candidates Donald Trump and Robert F. Kennedy Jr. appealed to the Bitcoin community for votes, the right-leaning Big Tech bro’s sunk their claws further into the once potentially revolutionary project.

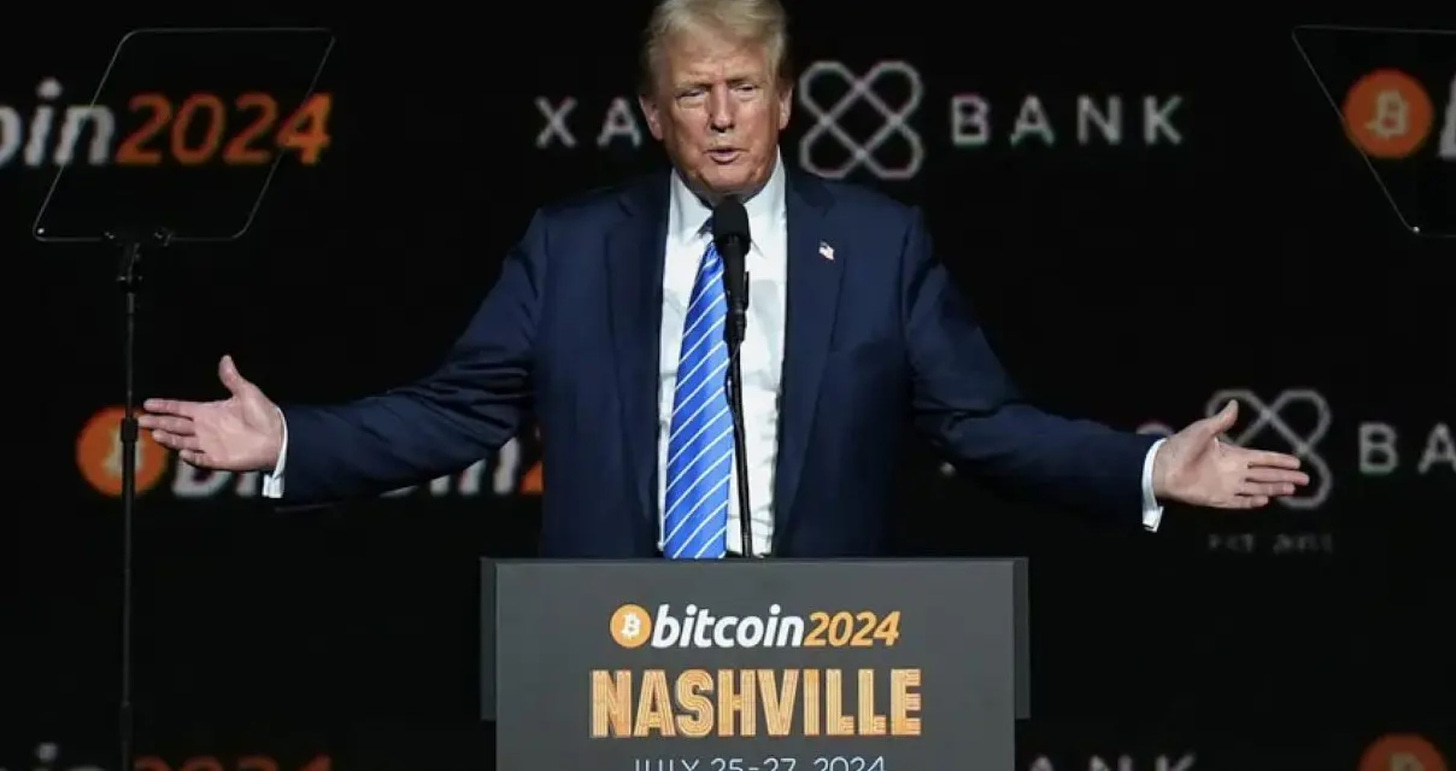

Former President Donald Trump and Independent Presidential candidate Robert F. Kennedy, Jr courted voters at the BTC Nashville Conference this past weekend. Both men made promises to change the Biden administration’s policy of criminalizing elements of the cryptocurrency industry.

Kennedy said as president he would sign an executive order directing the Department of Justice and the U.S. Marshals to “transfer the approximately 200k Bitcoin held by the U.S. government to the U.S. Treasury where it shall be held as a strategic asset”. Kennedy said he would also direct the U.S. Treasury to purchase 550 Bitcoin daily in an effort to put the U.S. in a “position of dominance that no other country will be able to challenge.”

Trump received a roar of applause and cheers when he called for the firing of Gary Gensler, Chair of the U.S. Securities and Exchange Commission. The former president proposed creating a national Bitcoin “stockpile” that he would “transform” into a “permanent national asset to benefit all Americans”.

The irony of both Trump and Kennedy’s proposals is that the U.S. government’s current Bitcoin reserves have come from arrests of individuals involved in the Bitcoin space. Trump acknowledged this fact, stating, “Most of the Bitcoin currently held by the United States government was obtained through law enforcement action.”

This includes Ross Ulbricht, a libertarian and hero to the Bitcoin community who has spent the last 13 years of his life behind bars after being sentenced for allegedly running the Silk Road dark web marketplace. Trump and RFK Jr. have promised to commute Ulbricht’s multiple life sentences.

While Trump pledged to ease law enforcement actions, commute Ulbricht, and fire Gensler, he also appeared ill informed of how Bitcoin and blockchain technology function. The one-time crypto skeptic seemed ignorant of the original intention of Bitcoin as “digital cash” that could help individuals avoid government and big banks.

“Those who say that Bitcoin is a threat to the dollar have the story exactly backwards,” Trump stated. “I believe it is exactly backwards. Bitcoin is not threatening the dollar. The behavior of the current US government is really threatening the dollar.”

Trump is correct that the U.S. government is a threat to the future of Bitcoin as a potentially revolutionary financial tool, but he is mistaken when he says Bitcoin is not a threat to the dollar.

For many of the “cypherpunks” who helped elevate Bitcoin in its early years, the growth of Bitcoin has carried the disappointment that the vast majority of new users do not seem to understand the radical libertarian vision of cryptocurrency as a tool for ending central banks, and liberating money from the hands of tyrannical governments.

This is what makes Trump’s statements and his recent wave of support from right-leaning Big Tech bro’s — who also are embracing Bitcoin — all the more worrisome.

Is Donald Trump’s support for Bitcoin due to him realizing the potential for the underlying technology? Is he simply an opportunist trying to cash in on the hype around Bitcoin? Has he had a change of heart and is now a burgeoning cypherpunk? Or, is there a financial and political incentive for Trump and the billionaires backing him to further entrench themselves into the Bitcoin ecosystem?

How Big Tech Bro’s Turned Trump into the “Crypto President”

As recently as June 2021, Donald Trump said that Bitcoin “seems like a scam” and “takes the edge off of the dollar and the importance of the dollar”. So how (and why) did Trump begin to promote the idea of Bitcoin being held by the U.S. treasury?

Trump’s transformation from a critic of cryptocurrency to a champion of the technology was not a natural progression from ignorance to informed of the ins and outs of the industry. Rather, Trump’s alleged change of heart is the result of an injection of millions of dollars into his campaign by billionaires who are tied to the crypto industry in one form or another. Of course, these billionaires are not promoting the cypherpunk vision of a currency freed of government surveillance, but instead are advocating for the idea that Bitcoin is “digital gold” to be held as a long-term investment.

In June, big tech venture capitalists David Sacks and Chamath Palihapitiya hosted a fundraiser for Trump at Sacks’ home in the Pacific Heights neighborhood of San Francisco. The meeting netted the Trump campaign $12 million after Trump reportedly said he would be “the crypto president”.

David Sacks is most well-known for his involvement in the early days of PayPal, serving as the Chief Operating Officer. Sacks is also a member of the so-called “PayPal Mafia”, a name given to the founders of PayPal who later founded numerous tech companies, including Tesla, LinkedIn, Palantir Technologies, SpaceX, YouTube, and Yelp.

Other crypto investors in attendance included twins Tyler and Cameron Winklevoss, founders of crypto exchange Gemini.

Joe Lonsdale, co-founder of Palantir and managing partner of the firm 8VC, has also donated $1 million to America PAC in support of a 2nd Trump administration.

Rolling Stone also reported on donations from other tech firms, including Shaun Maguire of VC firm Sequoia Capital, donating $300,000 to Trump, and Ken Howery of VC firm Founders Fund giving $1 million. Howery is considered a member of the PayPal Mafia due to his involvement in the early days of the company.

Howery co-founded the Founders Fund with Peter Thiel, another infamous big tech giant who is a member of the PayPal Mafia and has long been connected to intelligence networks via Palantir. Palantir also played a major role in COVID-19 surveillance. Thiel has recently gained well-deserved scrutiny for his role in financing the rise of Donald Trump’s Vice Presidential pick, J.D. Vance.

J.D. Vance, the 39-year old Ohio Senator, was in attendance at David Sacks’ June fundraiser for Donald Trump. In fact, according to “two people with knowledge of the exchange”, during the event Trump “informally polled the room” regarding who he should choose for his Vice Presidential running mate. David Sacks, Chamath Palihapitiya, and others all told Trump he should choose Vance. Elon Musk also reportedly encouraged Trump to pick Vance. A few weeks later at the Republican National Convention that’s exactly what Donald Trump did.

J.D. Vance claims that after hearing Peter Thiel deliver a speech at Yale Law School in 2011 he was inspired to pursue a career in big tech firms. Vance briefly worked at biotechnology firm Circuit Therapeutics, a move which then-CEO Frederic Moll told the NY Times was a “favor to Peter.”

In 2019, Vance would found his own venture firm, Narya Capital, with financial backing from the former Google CEO Eric Schmidt, the billionaire investor Marc Andreessen, and Peter Thiel.

Informed readers will recall that both Peter Thiel and Eric Schmidt are steering committee members of the secretive and infamous Bilderberg Group. This fact is all the more intriguing when considering that Schmidt tends to donate to Democratic Party candidates and Thiel’s network is embracing the Republican Party presidential candidate. No matter which party wins, they will have one of the Bilderberg Group’s steering committee members to thank.

Peter Thiel went on to give $15 million to Vance’s 2022 campaign for Senate. David Sacks, PayPal Mafia alum, also contributed $1 million to a political action committee supporting Vance’s Senate run.

The effort to put Vance in the U.S. Senate came as a result of funding from the little known Rockbridge Network. First reported on in 2022 by the NY Times, the Rockbridge Network is made up of Trump’s biggest donors, including Thiel and Rebekah Mercer, the daughter of billionaire Robert Mercer. The Rockbridge Network claimed their goal was to heavily influence and shape the American conservative movement by spending at least $30 million on “conservative media, legal, policy and voter registration projects”. The movement is also an attempt by the American right and conservatives to compete with Democrat donors and funding organizations.

“We need to show our side is organized and has the necessary institutional know-how and financial support, in order to have any shot at winning future elections,” a brochure for the Rockbridge Network stated.

The brochure said Rockbridge will “leverage our investors’ capital with the right political expertise” to “replace the current Republican ecosystem of think tanks, media organizations and activist groups that have contributed to the Party’s decline with better action-oriented, more effective people and institutions that are focused on winning.”

Rockbridge also called for spending $8 million on public relations, messaging, influence programs, and investigative journalism to promote their chosen candidates.

Considering all of the above facts, this means numerous members of the PayPal Mafia — David Sacks, Ken Howery, and Peter Thiel — are heavily invested in the Trump campaign and responsible for his push towards acceptance of Bitcoin. Additionally, at least two big tech acolytes with connections to Palantir are also investing in Trump — Peter Thiel and Joe Lonsdale.

BTC Nashville and the Capturing of Bitcoin

The BTC Nashville event was notably pro-Trump, featuring red “Make Bitcoin Great Again” hats and numerous “Vote Trump” signs and shirts. While the average Bitcoin supporter might not care much about politics, they absolutely care about seeing Bitcoin’s dollar valuation increase. This narrow focus on mainstream acceptance and profits has allowed the billionaires to infiltrate the Bitcoin space and shift it away from the original radical vision of liberated money towards a neutered financial asset which wealthy folks can hold in their portfolios.

Bitcoin Magazine and the annual BTC conference are both operated by BTC, Inc. Mike Germano became president at BTC Inc. sometime after leaving VICE Media relating to sexual harassment allegations. Germano is also lining up behind Donald Trump, tweeting a picture with Donald Trump Jr. in June and stating, “We are going to win!”.

Prior to the BTC Nashville conference, Bitcoin Magazine‘s CEO David Bailey, stated his goal of raising $15 million for Trump’s campaign. Following the conference Bailey tweeted that Trump raised $21 million throughout the three day gathering. Bailey said the majority of the funds came from from a “combo of industry and whales/OGs“. Whales is a term used to describe individuals who are holding massive amounts of Bitcoin.

One of the other major financial players to back Donald Trump’s presidency is Howard Lutnick, CEO of Cantor Fitzgerald investment firm. Lutnick spoke at BTC Nashville prior to Trump and stated that Cantor Fitzgerald owned a “shit load” of Bitcoin.

The BTC community celebrates this, but do they know this dude?

Howard Lutnick helped Rumble go public with $400M, he also helped raise millions for the Clintons and used to be Epstein’s next door neighbor.

Rumble is also a huge presence here, they are connected to Thiel,… https://t.co/eYRcI2uF24

— Derrick Broze (@DBrozeLiveFree) July 27, 2024

During his own speech, Donald Trump mentioned Lutnick, calling him “incredible” and “one of the truly brilliant men of Wall Street”. That Trump sees Lutnick — one of the most high profile traders of U.S. debt and a Wall Street regular — as a brilliant man is likely a sign that Wall Street banks will continue to influence U.S. financial policy under a potential Trump administration.

Lutnick has spoken at the World Economic Forum’s various meetings as far back as 2016 and as recently as January 2023. At the 2023 WEF meeting in Davos, Switzerland, Lutnick participated in a panel titled, Real Estate at a Turning Point.

Another interesting facet of Lutnick’s personal story is that Cantor Fitzgerald’s offices were located in the 101st to the 105th floors of One World Trade Center. The firm lost 658 of its 960 employees due to the terrorist attack. However, Lutnick happened to be accompanying his wife as she took their son to his first day of kindergarten.

Lutnick is also in proximity to Peter Thiel and J.D. Vance via Cantor Fitzgerald’s recent multi-million dollar investment in Strive Enterprises, Inc, a financial services company founded by former Republican Presidential candidate Vivek Ramaswamy. Peter Thiel, the Founders Fund, and J.D. Vance’s Narya Capital also contributed to the $30 million funding round.

Although members of the PayPal Mafia were not present in Nashville, the presence of the big tech bro’s was felt in the form of BTC Nashville sponsor and Canadian “free speech video platform” Rumble.

The Rumble Connection

Rumble has been touted as the go-to place to avoid the censorship prominent on Google’s YouTube. Rumble says its mission is to “restore the Internet to its roots by making it free and open once again”. The platform has experienced rapid growth as conservative commentators and influencers looked to Rumble as a refuge from the bias of left-leaning Big Tech companies.

The company was originally founded in 2013 by Chris Pavlovski, but did not experience rapid growth until 2020 when YouTube began censoring stories relating to the COVID-19 crisis. In May 2021, the platform received a welcome influx of cash from Peter Thiel and J.D. Vance’s Narya Capital. As part of the deal Ethan Fallang of Narya joined Rumble’s board.

The “neutral” video platform continued to grow as it added content creators like journalist Glenn Greenwald, who launched his “System Update” channel on Rumble in August 2021.

In September 2021, Rumble announced that comedian, actor, and podcaster Russell Brand would stream his show “Stay Free with Russell Brand” exclusively on Rumble. One year later, Greenwald announced that his show would now stream exclusively on Rumble.

In December 2021, Pavlovski announced his intention to take Rumble public by combining forces with CF Acquisition Corp, a division of the aforementioned Cantor Fitzgerald. The deal was completed by September 2022 with CF Acquisition Corp providing “approximately $400 million in gross proceeds” to help “build out Rumble’s independent infrastructure”.

“With its massive growth in users and engagement, this is an exciting time for Rumble to become public. I am excited to see ‘RUM’ shares trading in the marketplace,” Howard Lutnick, Chairman and CEO of Cantor Fitzgerald and CFVI, said at the time of the deal.

Following Rumble becoming a publicly traded company, the top institutional share holders include Cantor Fitzgerald, Vanguard Group, BlackRock, State Street, and Rockefeller Capital Management, among others.

As noted above, Lutnick spoke at the BTC Nashville conference while Rumble was a major sponsor. Both Pavlovski and Russell Brand also spoke at the gathering attended by thousands of Bitcoin advocates.

The relationship between Rumble and the right-leaning big tech bro’s was further strengthened when David Sacks — the PayPal Mafia member who hosted a $12 million fundraiser for Trump in June — joined the board of Rumble in June 2023.

To be clear, Rumble has benefited from the financial support of Peter Thiel, J.D. Vance, David Sacks, and Howard Lutnick — individuals with ties to PayPal, Palantir, the Bilderberg Group, and the World Economic Forum — who are focused on pursuing a vision of Bitcoin which is antithetical to the original vision of the digital currency.

The Push for Stablecoin Surveillance

The big tech billionaire networks behind Donald Trump’s conversion to “the crypto president” are well aware that convincing the Bitcoin community to embrace Trump is essential to their victory in November. More importantly, they recognize that winning over the Bitcoin community will make their transition towards the Bitcoin dollar much smoother.

These efforts are not only about reaping billions of dollars in profit. The bigger play is to maintain U.S. dollar dominance using Bitcoin and promoting so-called stable-coins which are pegged to the U.S. dollar and can be tracked and traced in a similar fashion to the Central Bank Digital Currencies (CBDCs) Trump promises to fight.

Journalists Whitney Webb and Mark Goodwin recently outlined this aspect of the co-opting of Bitcoin in a report for Unlimited Hangout:

“Thus, any policy that unites bitcoin and the dollar – whether under Trump or another future president – would most likely be aimed at enabling the same monetary policy that currently threatens the dollar. The most likely outcome under Trump, as outlets like CNBC have speculated, would be making bitcoin a reserve asset and, as a consequence, a sink for the inflation caused by the government’s perpetual expansion of the money supply. Ironically, bitcoin would then become the enabler of the very problem it had long been heralded as solving.”

Further, Webb and Goodwin note that Bitcoin “would then become the anchor that would allow the U.S. government to weaponize the dollar against economies where local currencies fail to withstand the pressures of an increasingly unstable economy, effectively supplanting the local currency with digital dollars”.

This would allow the U.S. government to expand their financial surveillance capabilities to the “billions and billions of people” who will be onboarded onto stablecoin platforms like Tether (USDT). Additionally, Tether and Circle have purchased more than $100 billion of U.S. government debt in the form of U.S. Treasury securities. This puts the firms funding the stable-coins in a powerful economic position, including BlackRock Inc.

Webb and Goodwin also point out that Tether has cooperated with governments to freeze wallets allegedly linked to terrorism and human trafficking. Would Tether and Circle act in a similar manner if the U.S. government demanded the freezing of wallets operating outside the increasingly regulated crypto sphere?

“Thus, Trump’s rejection of CBDCs but embrace of dollar stablecoins on Saturday shows a rejection of direct digital currency issuance by the Federal Reserve, not a rejection of surveillable, programmable money,” Webb and Goodwin conclude.

Webb and Goodwin have previously reported on the role BlackRock’s Larry Fink is playing in the “tokenization” of everything using Bitcoin as cover.

Fink has been a vocal critic of Bitcoin for years. Fink, along with Warren Buffett and Jamie Dimon, were famously “called out” by Peter Thiel at the 2022 BTC Conference as being part of a “finance gerontocracy” for their opposition to Bitcoin.

However, his tune has begun to change over the last year. Fink’s support for Bitcoin coincided with BlackRock’s announcement of a spot Bitcoin ETF application with the U.S. Securities and Exchange Commission (SEC) in June 2023. BlackRock’s Bitcoin ETF — iShares Bitcoin Trust — was approved in January 2024.

Following the Trump assassination attempt, Fink called Bitcoin “digital gold”, a “legitimate financial instrument”, and “protection against countries debasing their currency”.

Although Fink has yet to appear at influential meetings like the Bilderberg Group, Philipp Hildebrand, Vice Chairman of BlackRock, attended as far back as 2015.

Between Larry Fink, Howard Lutnick, Peter Thiel, David Sacks, and other Big-Tech Bitcoin bro’s, the infiltration of the Bitcoin space is nearly complete.

To sum up: billionaires with connections to the PayPal Mafia, Blackrock, the Bilderberg Group, and the World Economic Forum are going all in on Donald Trump’s presidential run in the hopes that he will help them continue the co-opting of Bitcoin.

"The chain always breaks at the weakest link." Questions: 1. Do people "buy" Bitcoin with paper currency, checks and electronic 'Money' i.e. credit & debit cards?

FACT: The FED has ownership and control over paper currency AND the origin of all electronic 'Money'.

2. How much Bitcoin have "THEY" bought and now hold?

3. WHERE....in what specific location, IS the place wherein prices of Bitcoin are "determined"? WHO determines the price? Where is found the evidence of this, if any? Who is auditing the BID-ASK Process?

4. Is the bitcoin price & buying and selling dependent on price transmission on a GOV'T / Central Bank created, controlled regulated 'electronic network', i.e., the "internet"?

5. Can the creators of the internet filter and cutoff any kind of data transmission "They" feel or think is detrimental to their purchasing power over their own "currency"/ electronic 'Modern Money'?

6. Is having, being in possession of superior electronic knowledge on how the internet works, make it possible for those same persons, to edit, censor or eliminate unfavorable data, detrimental to their power over price and currency value?

Respectful, Kind Regards to All FMR Intelligence Officer